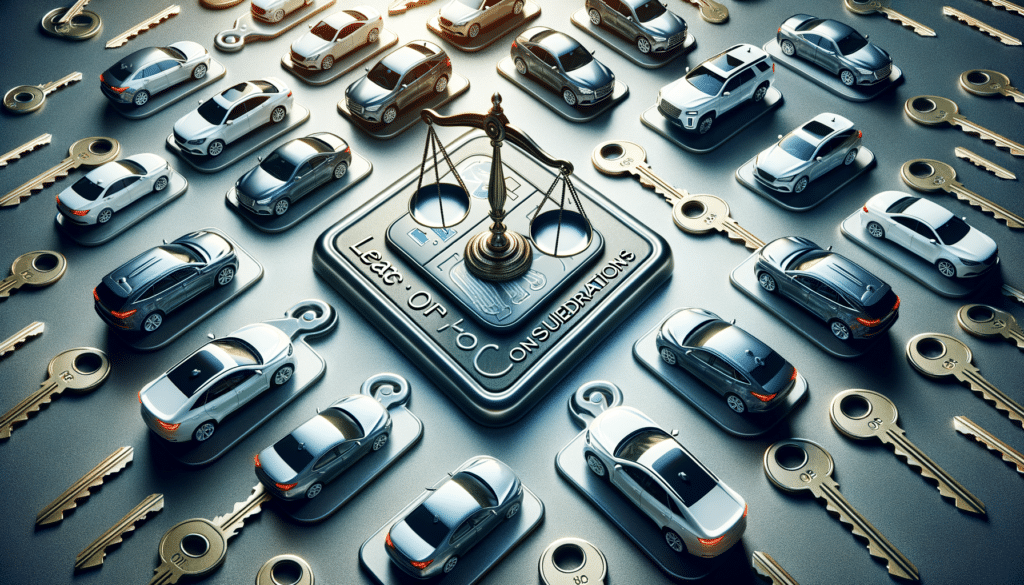

Understanding Car Leasing: An Overview

Car leasing is an increasingly popular option for individuals who desire flexibility and affordability in their vehicle choices. Unlike purchasing a car outright, leasing allows consumers to essentially “rent” a vehicle for a predetermined period, typically two to four years. This arrangement often results in lower monthly payments compared to buying, as lessees only pay for the vehicle’s depreciation during the lease term, plus interest and fees.

One of the primary attractions of leasing is the ability to drive a new car every few years without the hassle of selling or trading in an old model. This can be particularly appealing to those who enjoy having the latest features and technology in their vehicles. Leasing also generally includes warranty coverage, which can alleviate concerns about maintenance costs. However, it’s essential to understand the terms and conditions, such as mileage limits and potential fees for excessive wear and tear, which can affect the overall cost-effectiveness of leasing.

Financial Implications of Car Leasing

From a financial perspective, car leasing can be a smart choice for many consumers. The lower monthly payments are often a key selling point, making it easier for individuals to budget for a nicer or more luxurious vehicle than they could afford if purchasing. Additionally, leasing typically requires a smaller down payment, freeing up cash for other investments or expenses.

However, it’s important to consider the long-term financial implications. Leasing is not an investment; at the end of the lease term, you do not own the vehicle. This means there is no residual value or asset to sell or trade in. For some, this lack of ownership is a downside, while others appreciate the freedom from the responsibilities of ownership. It’s crucial to weigh these factors against personal financial goals and lifestyle preferences.

Comparing Leasing and Buying: Which is Right for You?

Deciding between leasing and buying a car is a personal choice that depends on various factors, including financial situation, driving habits, and personal preferences. Leasing offers flexibility and lower upfront costs, making it attractive to younger drivers or those who prefer changing cars frequently. On the other hand, buying a car can be more cost-effective in the long run, especially for those who drive extensively or plan to keep the vehicle for many years.

When comparing the two options, consider the following:

- Mileage: Leasing agreements often include mileage limits, with fees for exceeding them. Buying is better for high-mileage drivers.

- Customization: Leased vehicles must be returned in their original condition, limiting customization options.

- Ownership: Buying allows for ownership and the potential to sell or trade in the vehicle later.

Ultimately, the decision should align with individual needs and financial circumstances.

Environmental Considerations in Car Leasing

In an era where environmental consciousness is increasingly important, car leasing can play a role in reducing one’s carbon footprint. Newer cars generally have improved fuel efficiency and lower emissions compared to older models. Leasing allows consumers to access these advancements more frequently, contributing to environmental sustainability.

Furthermore, the automotive industry is rapidly evolving, with electric and hybrid vehicles becoming more prevalent. Leasing can be an excellent way to test these technologies without committing to a long-term purchase. This option provides flexibility as infrastructure and technology continue to develop, ensuring that consumers can adapt to changes in the market.

Conclusion: Making an Informed Decision

Car leasing offers a blend of flexibility, affordability, and access to the latest automotive technologies, making it an appealing option for many consumers. However, it is essential to carefully consider the terms and financial implications to ensure that leasing aligns with personal needs and goals. By weighing the benefits and potential drawbacks, consumers can make informed decisions that suit their lifestyle and financial situation. Whether opting for leasing or buying, the key is to choose the option that offers the most value and satisfaction.